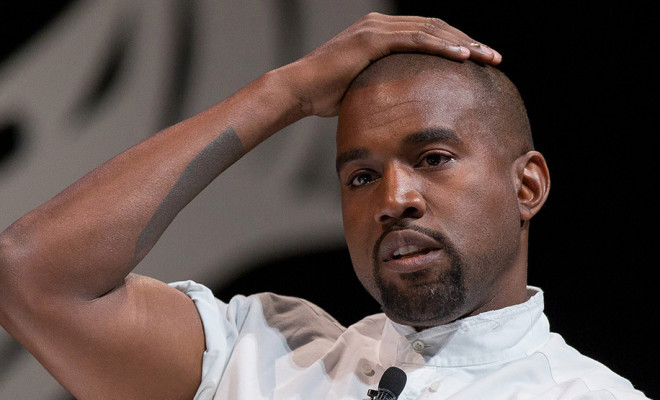

How to get out of debt like Kanye West

So… not sure if you have heard yet, but, the Rapper Kanye West is apparently $53 Million dollars in debt. Not only that but he has been reaching out to other wealthy business owners to ask for money to help with his debt.

He was recently sighted twittering to Facebook owner and developer Mark Zuckerberg and Google’s Larry Page. He reached out to them to ask for investment capital in upwards of $1 Billion dollars to “Have access to more money to bring more beautiful ideas into the world”. As to how this will actually turn out for Kanye we do not know; we can only speculate that those cat like, bounce back attributes that he raps about all the time will kick in and fix this little $53 million dollar hiccup in no time.

But…

For those of use that don’t have Billion dollar company owner friends to reach out to help bail us out what do we do if we get $53 million in the hole? Well hopefully that is not your current financial standing but for those of us that are closer to the $15 to $20 thousand dollar range here are some things that can help you.

There is a concept that you can use called Debt Stacking that is very popular in the personal financial industry right now. It actually comes highly recommended by Dave Ramsey and Suze Orman.

With the right Financial Company you can find the right company to spear head your Debt Stacking Program for you. The concept is simple and very easy to follow as well.

Basically, you target your list of accounts you want to pay off. After doing this initial set, you pay on your accounts until you have paid the lowest balance of first. After that balance is paid you take that payment amount and roll into the next account. This works great because now have one account paid off and you are increasing your payment on the next account allowing you to pay it off faster. You continue the process until the last account is paid off.

Debt Stacking is a very simple concept and very effective when you implement it into your plan to wipe out your debt.

Another awesome part of the plan is that when you have paid your last account off completely you will have additional income now and you can use that money to pay into your investment account. What this does not is allow you to pay yourself and grow your investment portfolio.

For more TIPS and ways to find out how you can get started towards Debt Stacking to get rid of your debt quickly, get Financial Information and contact a Financial Coach leave a comment and we will be happy to help you.

Happy Friday!!

See you next week